The Indian government introduced the Ayushman Bharat Health Account (ABHA) card in 2022, bringing transition in healthcare management. But what exactly is an ABHA card and how does it influence car insurance sector? Let’s dive in and understand about ABHA card in India with this comprehensive guide.

Table of Contents

What is an ABHA card?

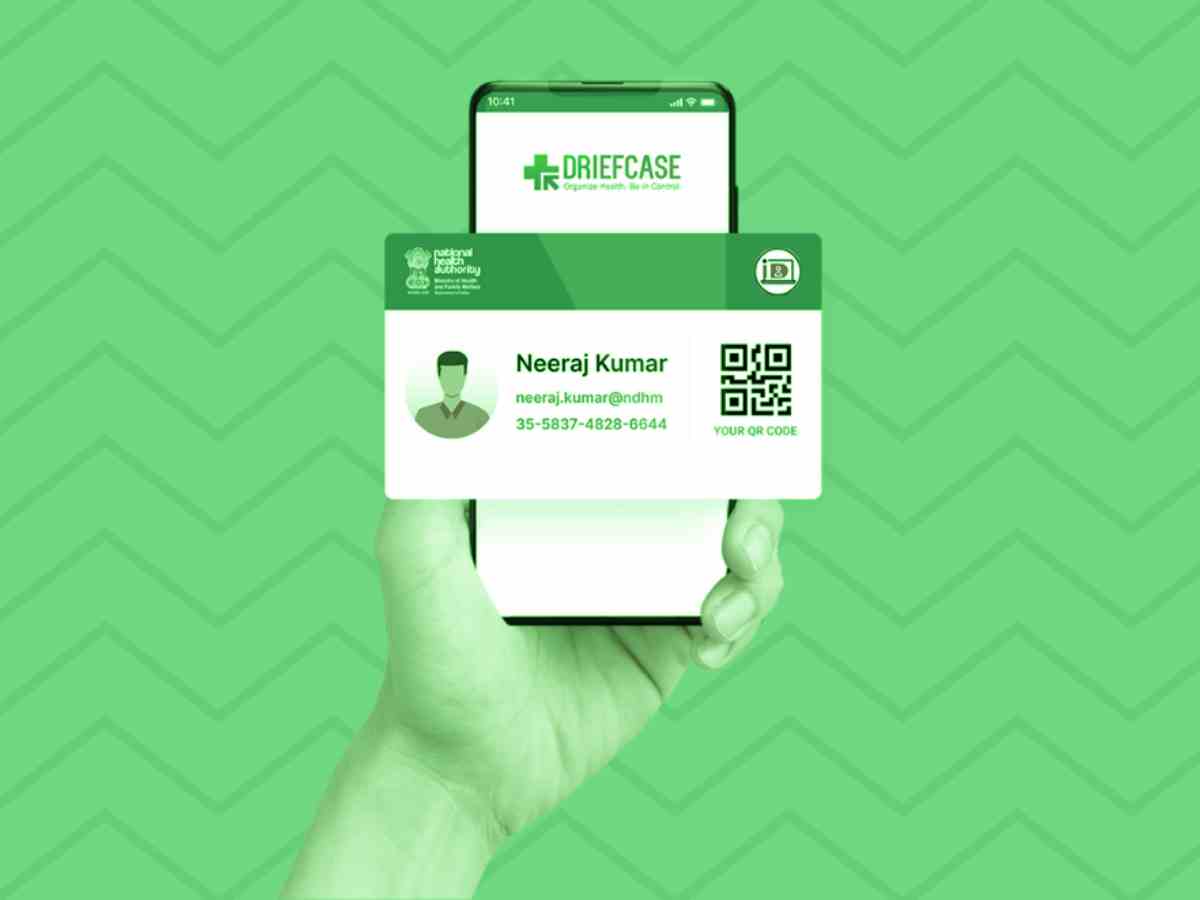

ABHA card is a unique digital health ID that stores an individual’s medical history, test report and medical records. This portable, secure card enables seamless healthcare access and streamlines medical data management. It is a part of the Ayushman Bharat Digital Mission, aimed at creating a national digital health ecosystem in India.

What are the benefits of ABHA card?

Here are some of the benefits of ABHA card which are mentioned below:

- Unified medical records: ABHA card consolidates medical records and data for easy access. You can access to medical records and reports, anytime, anywhere with ABHA card.

- Improved medical care conditions: ABHA card enhances doctor-patient communication.

- Safe data storage: It protects your sensitive medical information which cannot be accessed by others.

- Increased efficiency: With ABHA card, paperwork and administrative burdens has reduced significantly.

- Efficient patient management: ABHA card provides quick access to patient history for healthcare providers.

- Reduced errors: Accurate medication and treatment tracking can be done through ABHA card.

Key features of ABHA card

- ABHA card assigns a unique fourteen-digit health identification number.

- It stores medical data, records and reports which is not accessible to others.

- It ensures data privacy by secured and consent-based data sharing.

- Provides linkage to existing medical records and reports (if linked).

- Accessibility through mobile app or website.

How does ABHA Card influence car insurance?

While ABHA Card focuses on healthcare, its implications extend to car insurance sector. Here’s how it impacts car insurance in India:

- Data integration: ABHA card’s digital framework can inspire insurer from car insurance sector to adopt similar data-driven approaches.

- Risk assessment: ABHA card provides access to medical history to refine risk assessments for car insurance policyholders.

- Claims processing: Streamlined medical data and records can expedite car insurance claims related to accidents or injuries.

How to create an ABHA card?

The ABHA card is a significant step towards a digital, interconnected healthcare ecosystem in India. Here’s how you can create an ABHA card:

- Visit official website of National Health Authority and register on it for creating ABHA card.

- Provide basic information like identification, address proof and contact details.

- Link existing medical records with ABHA Card, to completely create an ABHA card.

The final note

The ABHA card represents an outstanding leap forward in healthcare management. Its impact for car insurance highlights the potential for interconnected or data-driven insurance solutions in the future. Insurer can enhance policyholder’s experiences and create a more integrated, efficient industry by embracing the ABHA card’s innovative approach.